The Securities and Exchange Commission (SEC) recently announced that, for fiscal year 2023, it filed more total and original (“standalone”) enforcement actions than it did in 2022.

The SEC’s Nov. 14 filing, detailing its 2023 enforcement actions, illustrated another busy year for the Division of Enforcement (DoE). Among the year’s highlights:

- 784 total enforcement actions

- Orders for $4.95 billion in financial remedies

- $930 million distributed to harmed investors in 2023

“The Division’s many accomplishments over the past fiscal year reflect the efforts of a staff that remains steadfastly focused on fulfilling the SEC’s investor protection mandate,” said Sanjay Wadhwa, Deputy Director of the Division of Enforcement. “The breadth and complexity of the issues addressed in our actions filed last year demonstrate the staff’s unwavering resolve, including when confronted by well-heeled adversaries, to doggedly pursue bad actors in every corner of the securities industry and hold them accountable for their transgressions.”

Enforcement Actions

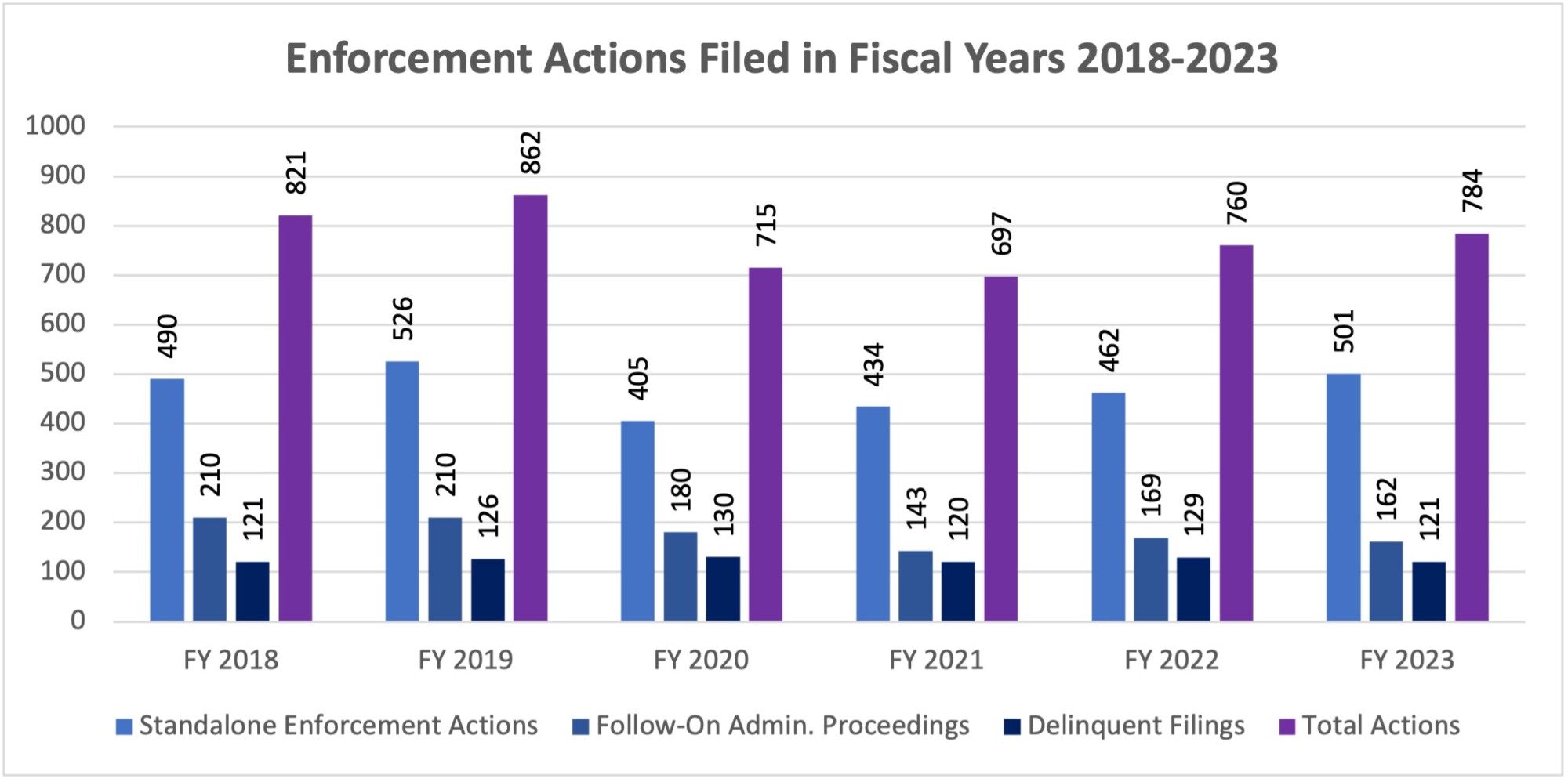

The SEC’s 784 enforcement actions in 2023 were up 3% over 2022’s numbers. Its actions are broken down into three categories:

- 501 standalone enforcement actions (+8% YoY)

- 162 follow-on administrative proceedings (-4% YoY)

- 121 actions against issuers who were allegedly delinquent in making required filings with the SEC (-6% YoY)

Source: SEC

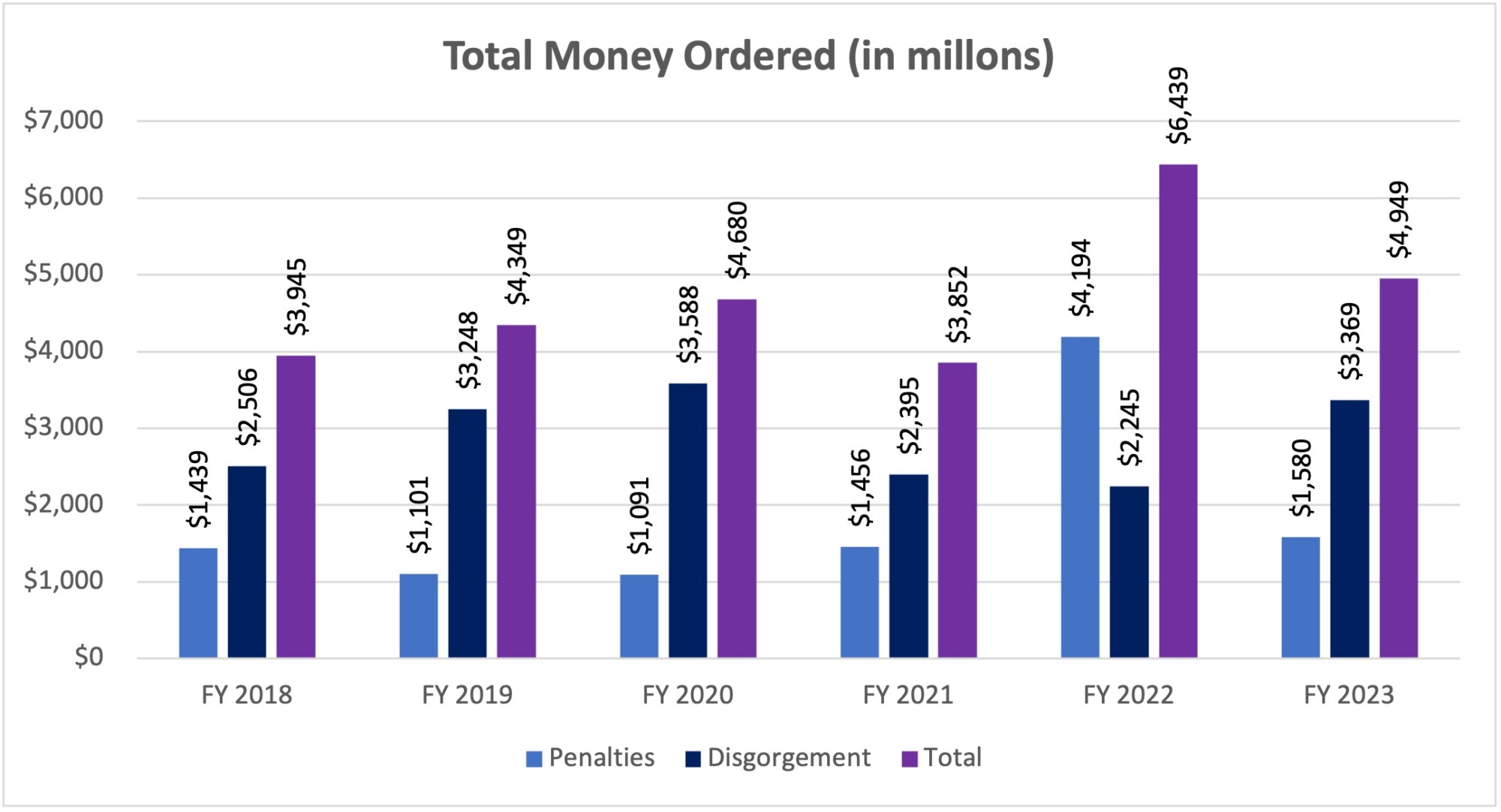

Financial Remedies

The SEC’s $4.95 billion in financial remedies marked the second highest amount in commission history, behind only 2022. Of that number, $3.37 billion was from disgorgement and prejudgment interest, while $1.58 billion was from civil penalties – both the second-highest amounts on records.

Source: SEC

The SEC ended up distributing $930 million to harmed investors in 2023 – the second consecutive year this figure eclipsed the $900 million mark.

Lastly, the commission obtained orders barring 133 individuals from serving as officers and directors of public companies, which is the largest such number tallied in a decade.

Whistleblowers

The SEC also announced that nearly $600 million was awarded through its Whistleblower Program. That marked an all-time record, as did the $279 million it awarded to a single whistleblower.

The commission reported a 13% increase in tips, complaints and referrals in 2023, to more than 40,000 across the year. That included more than 18,000 whistleblower tips, up 50% YoY and shattering the prior year’s record.

Noteworthy Actions

Here are a few of the SEC’s most noteworthy actions in fiscal 2023:

- The SEC charged Goldman Sachs & Co. LLC for failing to provide complete and accurate securities trading information to the SEC over a 10-year period, representing some 163 million transactions. Goldman admitted the findings in the SEC’s order and paid a $6 million civil penalty to resolve the SEC’s charges.

- The SEC charged Merrill Lynch and its parent company, BAC North America Holding Co., with failing to file hundreds of Suspicious Activity Reports from 2009 to late 2019. Merrill Lynch paid a $6 million penalty to settle the charges.

- The SEC settled charges against telecommunications company GTT Communications, Inc. for failing to disclose material information about unsupported adjustments the company made in several Commission filings that increased GTT’s reported operating income by at least 15% in three quarters. GTT avoided a civil penalty order, with the SEC crediting the telecom with promptly self-reporting, undertaking affirmative remedial measures, and providing substantial cooperation to the SEC.

- The SEC barred a former Wells Fargo executive from serving as an officer or director of a public company as part of a settlement of fraud charges for misleading investors about the success of Wells Fargo’s core business. The former executive also agreed to pay a $3 million civil penalty and more than $1.9 million in disgorgement and prejudgment interest.

- The SEC’s investigations resulted in litigated charges alleging massive crypto frauds, including charges against FTX CEO Samuel Bankman-Fried and other FTX executives; Terraform Labs and its founder Do Kwon; and Richard Heart and three entities that he controls: Hex, PulseChain, and PulseX.

The full 2023 enforcement results release, including a fuller list of noteworthy actions, is available here on SEC.gov.